Federal tax calculator 2020

2020 Marginal Tax Rates Calculator. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

What Are Marriage Penalties And Bonuses Tax Policy Center

We can also help you understand some of the key factors that affect your tax return estimate.

. The calculator listed here are for Tax Year 2020 Tax Returns. And is based on the tax brackets of 2021 and 2022. The Income Tax Rates and Thresholds used depends on the filing status used when completing an annual tax return.

Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal income tax brackets and rates. Americas 1 tax preparation provider. Ad Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading. Search for other IRS or State Tax Forms here. It is mainly intended for residents of the US.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Do you have a Valid SSN. The 2020 Tax Calculator uses the 2020 Federal Tax Tables and 2020 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

2020 Federal Income Tax Calculator. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. It is mainly intended for residents of the US.

Self-employment forms or a Schedule C. Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Self-Employed defined as a return with a Schedule CC-EZ tax form.

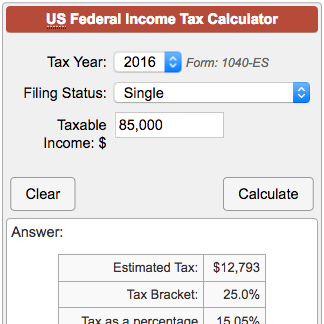

Enter your filing status income deductions and credits and we will estimate your total taxes. How to calculate Federal Tax based on your Annual Income. Taxable income Your taxable income is your adjusted gross income minus deductions standard or itemized.

Mark Your 2020 Taxes Off Your List Today. Use your estimate to change your tax withholding amount on Form W-4. Enter your income and location to estimate your tax burden.

1 online tax filing solution for self-employed. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. The 2021 tax values can be used for 1040-ES estimation planning ahead or comparison.

Does not include income credits or additional taxes. Tax filing status Taxable gross annual income subject to personal rates W-2 unearnedinvestment business income not eligible for 20 exemption amount etc. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that works for you Results are as accurate as the information you enter.

Ad Looking for calculate your tax refund 2020. THE DEADLINE PASSED BUT WE CAN STILL HELP. The calculator listed here are for Tax Year 2020 Tax Returns.

It is mainly intended for residents of the US. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS next April. 2020 Federal Income Tax Calculator 2020 Federal Income Tax Calculator You may experience an increase in your federal taxes going forward due to a number of provisions including personal exemption phaseouts limits to itemized.

Or keep the same amount. The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison. Does not include self-employment tax for the self-employed.

2020 Tax Calculator Rated 48 by 173 users on Verified Reviews. Our free tax calculator is a great way to learn about your tax situation and plan ahead. Family Income Deductions and Credits Tell us about yourself How will you be filing your tax return.

If withdrawn prior to age 59 12 there may be an additional 10 federal tax penalty imposed. Credit Karma Tax is the only software that offers a free option to file simple federal and state returns at no cost. Your household income location filing status and number of personal exemptions.

Taxable income 87450 Effective tax rate 172 Estimated. What You Need Have this ready. Single Married Filing Jointly Married Filing Separately Head of Household Qualifying Widow er What was your age on December 31 2020.

ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as. Free Income Tax Calculator - Estimate Your Taxes - SmartAsset Calculate your federal state and local taxes for the 2021-2022 filing year with our free income tax calculator. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

CALL NOW 866 871-1040. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS the following April. The 2020 Tax Calculator uses the 2020 Federal Tax Tables and 2020 Federal Tax Tables you can view the latest tax tables and.

This calculator is for the tax year 2020. How Income Taxes Are Calculated. Investors should consider their personal investment horizon and income tax bracket both current and anticipated when making an investment decision as these may further impact the comparison.

The calculator will calculate tax on your taxable income only. Use these 2020 Tax Calculators and Tools and 2020 Tax Forms to prepare mail and file your 2020 Return. Income Has Business or Self Employment Income.

And is based on the tax brackets of 2020 and 2021. With TurboTax Its Fast And Easy To Get Your Taxes Done Right. Content updated daily for calculate your tax refund 2020.

2020 Simple Federal Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes for tax year 2020. The Liberty Tax Service tax estimator can help you quickly and easily estimate your federal tax refund by following a few simple steps online. For the rest.

Paystubs for all jobs spouse too. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Estimate your US federal income tax for 2021 2020 2019 2018 2017 2016 2015 or 2014 using IRS formulas.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Filing Is Easy With TurboTax.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

How The Tcja Tax Law Affects Your Personal Finances

Federal Tax Calculator Sale Online 52 Off Www Wtashows Com

Federal Tax Calculator Sale Online 52 Off Www Wtashows Com

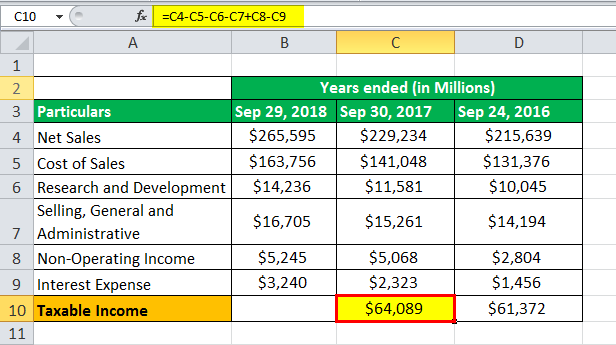

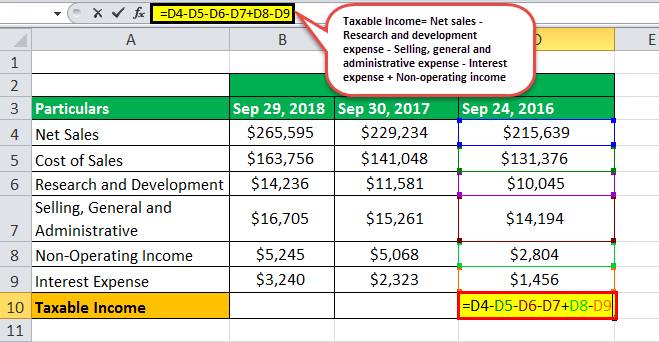

How Is Taxable Income Calculated How To Calculate Tax Liability

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

Taxable Income Formula Examples How To Calculate Taxable Income

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

2022 Income Tax Withholding Tables Changes Examples

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Taxable Income Formula Examples How To Calculate Taxable Income